As a founder, financial modelling may seem intimidating, but it is actually a powerful tool to tell your startup’s story through numbers. By projecting your company’s future performance, you can secure investments, make informed decisions, and drive growth.

Why Financial Models Matter

Before building a financial model, it is essential to understand its importance. There are two primary reasons;

Attract Investors

A well-constructed financial model shows investors your growth plan, capital needs, and potential returns.

Manage Your Business

Financial models help founders test strategies, forecast cash flow, and avoid running out of money.

Key Components of a Financial Model

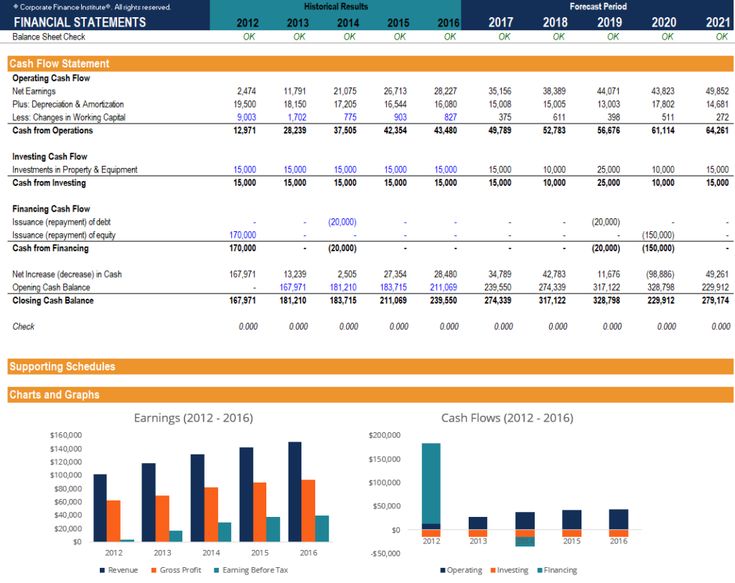

A robust financial model includes three core statements;

Income Statement: Summarises revenue, costs, and profits.

Balance Sheet; Provides a snapshot of assets, liabilities, and equity.

Cash Flow Statement; Tracks cash flow from operating, investing, and financing activities.

Building Your Financial Model

Follow these steps below to build a simple financial model;

Define Assumptions; outline growth rates, expenses, and key variables.

Forecast Revenue; project revenue based on assumptions and market factors.

Estimate Costs; list costs, including COGS and operating expenses.

Create Financial Statements; Construct Income Statement, Balance Sheet, and Cash Flow Statement.

Analyse and Refine; regularly review and update your model to test scenarios and make informed decisions.

Financial modelling is a crucial skill for founders. By mastering it, you can transform your business plan into a dynamic tool that attracts investors, manages resources, and drives success. Don’t just crunch numbers – craft a strategic narrative that drives your startup forward.

Discover more from Astudity Limited

Subscribe to get the latest posts sent to your email.