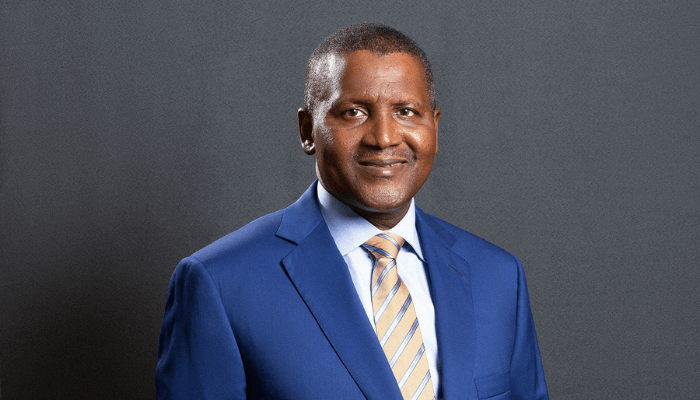

NGX, Capital Market Leaders Set For Dangote Fertiliser’s Listing

The Nigerian Exchange Group (NGX Group), alongside key capital market institutions, has signalled full readiness to support the upcoming listing of Dangote Fertiliser Limited—a strategic move expected to redefine Nigeria’s industrial and investment landscape. The announcement followed a high-level delegation tour of the Dangote Refinery and Fertiliser Complex, where NGX Group executives, market regulators, and […]

Read MoreKeystone Bank, Pan-Atlantic University Forge Strategic Alliance To Empower SMEs

In a bold move to strengthen Nigeria’s entrepreneurial backbone, Keystone Bank Limited has partnered with the Enterprise Development Centre (EDC) of Pan-Atlantic University to promote youth-led businesses, Small and Medium Enterprises (SMEs), and financial inclusion across the country. The Memorandum of Understanding (MoU) was signed on Tuesday, June 24, 2025, at Keystone Bank’s headquarters in […]

Read MoreNGX, SEC Strengthen Nigeria-China Investment Ties

In a bold stride toward global financial integration, the Nigerian Exchange Group Plc (NGX Group) and the Securities and Exchange Commission (SEC) are reinforcing Nigeria’s capital market linkages with China. The renewed push was spotlighted at the China-Africa CEO Dialogue held during the 4th China–Africa Economic and Trade Expo in Changsha. Co-hosted by Choice International […]

Read MoreAccess Bank Officially Acquires Standard Chartered Bank In The Gambia

In a landmark development within West Africa’s banking sector, Nigerian financial giant, Access Bank, has officially taken over Standard Chartered Bank’s operations in The Gambia, marking the end of the latter’s 130-year presence in the country. This was confirmed by the Governor of the Central Bank of The Gambia, Mr. Buah Saidy, during a press […]

Read MoreNNPC Posts N5.89trn Revenue, N748bn Profit In April

The Nigerian National Petroleum Company Limited (NNPC) has reported a robust revenue of N5.89 trillion and profit after tax (PAT) of N748 billion for the month of April 2025, signaling a renewed commitment to transparency and performance under its new leadership. This marks a sharp departure from previous years when monthly financial disclosures were suspended […]

Read MoreTAJBank Gets Approval For Second Tranche Of N100bn Sukuk

TAJBank Limited, Nigeria’s pioneering non-interest bank, has received the regulatory approval to issue the second tranche of its N100 billion Mudarabah Sukuk bond programme.Valued at N20 billion, the bond offers a competitive 20.5 percent annual return, reinforcing the bank’s commitment to ethical investing and financial inclusion. According to the bank, all necessary regulatory approvals have […]

Read MorePalmPay Tops Financial Times 2025 List

PalmPay, the rising fintech powerhouse focused on emerging markets, has earned top honours as the fastest-growing financial services company and #2 overall on the Financial Times’ Fastest-Growing Companies in Africa 2025 list, created in collaboration with Statista. The annual ranking celebrates standout African companies based on key indicators such as revenue growth, user adoption, and […]

Read MoreFG Expands Investment Access With Two New Savings Bonds

In a continued effort to diversify Nigeria’s funding sources and deepen retail participation in the financial markets, the Debt Management Office (DMO), on behalf of the federal government, has announced the issuance of two new Federal Government of Nigeria (FGN) Savings Bonds. The move is part of a broader macroeconomic strategy to enhance financial inclusion […]

Read MoreUBA Emerges Nigeria’s Strongest Financial Brand In 2025

United Bank for Africa (UBA) has achieved a significant milestone in global brand rankings, being named the strongest financial brand in Nigeria and the 13th strongest banking brand worldwide in the latest 2025 report by Brand Finance, a leading independent brand valuation consultancy. The report, which evaluates over 500 banking brands globally, highlights UBA’s dramatic […]

Read MoreFidelity Bank Partners SMEDAN To Accelerate MSME Growth

In a strategic move poised to redefine the future of small business in Nigeria, Fidelity Bank Plc has entered into a formal partnership with the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN). The goal: to unlock broader access to funding, markets, and growth opportunities for Nigerian micro, small, and medium enterprises (MSMEs) across […]

Read More