The Nigerian Exchange Group (NGX Group), alongside key capital market institutions, has signalled full readiness to support the upcoming listing of Dangote Fertiliser Limited—a strategic move expected to redefine Nigeria’s industrial and investment landscape.

The announcement followed a high-level delegation tour of the Dangote Refinery and Fertiliser Complex, where NGX Group executives, market regulators, and operators held extensive discussions on the listing’s transformative potential.

Mr. Temi Popoola, Group Managing Director (GMD)/Chief Executive Officer (CEO) of NGX Group, framed the development as a reflection of the Exchange’s evolving strength in mobilising large-scale investments. “In 2024 alone, Nigerian investors committed over N2 trillion to recapitalise the banking sector. With Dangote Fertiliser now poised to list, we are confident in our ability to repeat this scale of success—this time, with infrastructure to catalyse industrial growth,” Mr. Popoola said.

The listing of Dangote Fertiliser Limited, one of the continent’s largest fertiliser producers, is widely seen as a flagship moment for local and foreign investors eyeing long-term, foreign currency-backed returns.

Mr. Jude Chiemeka, CEO of Nigerian Exchange Limited (NGX), described the upcoming listing as proof of the Exchange’s capacity to drive value through strategic capital formation. “This deal highlights our strength as a marketplace for transformational assets. With a deep, liquid, and transparent platform, we are well-positioned to facilitate smooth execution and long-term investor confidence,” he said.

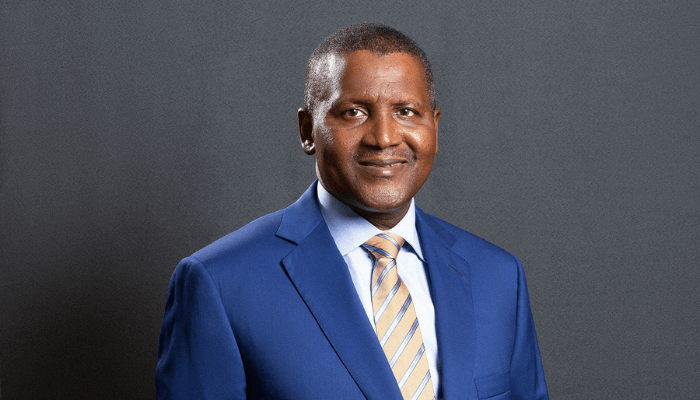

Mr. Aliko Dangote, President of the Dangote Group, confirmed the fertiliser arm’s robust growth outlook, revealing that the company is positioned to earn up to $20 million in daily revenue, with an expected cumulative earning potential of $70 billion. “This listing is not just about access to capital. It offers investors dollar-denominated opportunities, and aligns with our shared goal of driving Nigeria toward a $1 trillion economy,” he stated.

Mr. Umaru Kwairanga, Chairman of NGX Group, lauded Dangote’s long-standing role in market development, noting that his legacy of leadership at the Exchange continues to yield dividends. “From boardroom leadership to board listings, Alhaji Dangote has consistently exemplified how the private sector can be a force for national economic acceleration,” Mr. Kwairanga said.

The delegation included the CEOs of the Central Securities Clearing System (CSCS), NGX Regulation, Lagos Commodities and Futures Exchange, as well as the presidents of the Chartered Institute of Stockbrokers (CIS) and the Association of Securities Dealing Houses of Nigeria (ASHON)—a unified front that underscores market-wide endorsement for the deal.

As investor expectations mount, the NGX Group’s commitment to enabling access to capital for industrial champions remains clear. With the Dangote Fertiliser listing on the horizon, Nigeria’s capital markets are set to enter a new phase – one driven by innovation, industrialisation, and inclusive prosperity.

Discover more from Astudity Limited

Subscribe to get the latest posts sent to your email.