ABC Corp, a technology company, having prepared for its initial public offering (IPO), decided to implement a world class investor relations (IR) strategy. Below is how it leveraged best practices to ensure a successful capital raising event.

Understanding Its New IR ‘Customers’

In order to build a secure shareholder base, ABC Corp prioritised identifying its shareholders. The company used sophisticated tracking systems to monitor and quantified holdings, categorised investors, and provided actionable analyses to senior management. This effort, although high cost and time consuming, was essential for proactively managing its free float. ABC Corp understood that institutional investors, just like the company, valued knowing who owns the shares as it provided insights into potential stock evolution.

Attracting and Retaining New Shareholders

Rather than passively accepting any shareholder structure, ABC Corp defined its ideal shareholder base as part of its corporate strategy. It identified the types of shareholders it wanted and did not want, considering factors like maintenance costs and alignment with the company’s interests. By maintaining a pool of potential investors from diverse sectors and locations, ABC Corp ensured a steady demand for its shares.

Understanding Market Expectations

ABC Corp recognised the need to meet various market expectations. Retail investors were interested in short term share price projections, while analysts focused on long term earnings estimates. The company ensured its financial communications addressed these diverse expectations in both form and content.

Developing the Financial Calendar

ABC Corp planned its financial calendar to comply with legal disclosure deadlines. It focused on key announcements such as quarterly, interim, and full year results, as well as the annual general shareholders’ meeting.

Crafting Compelling Messages

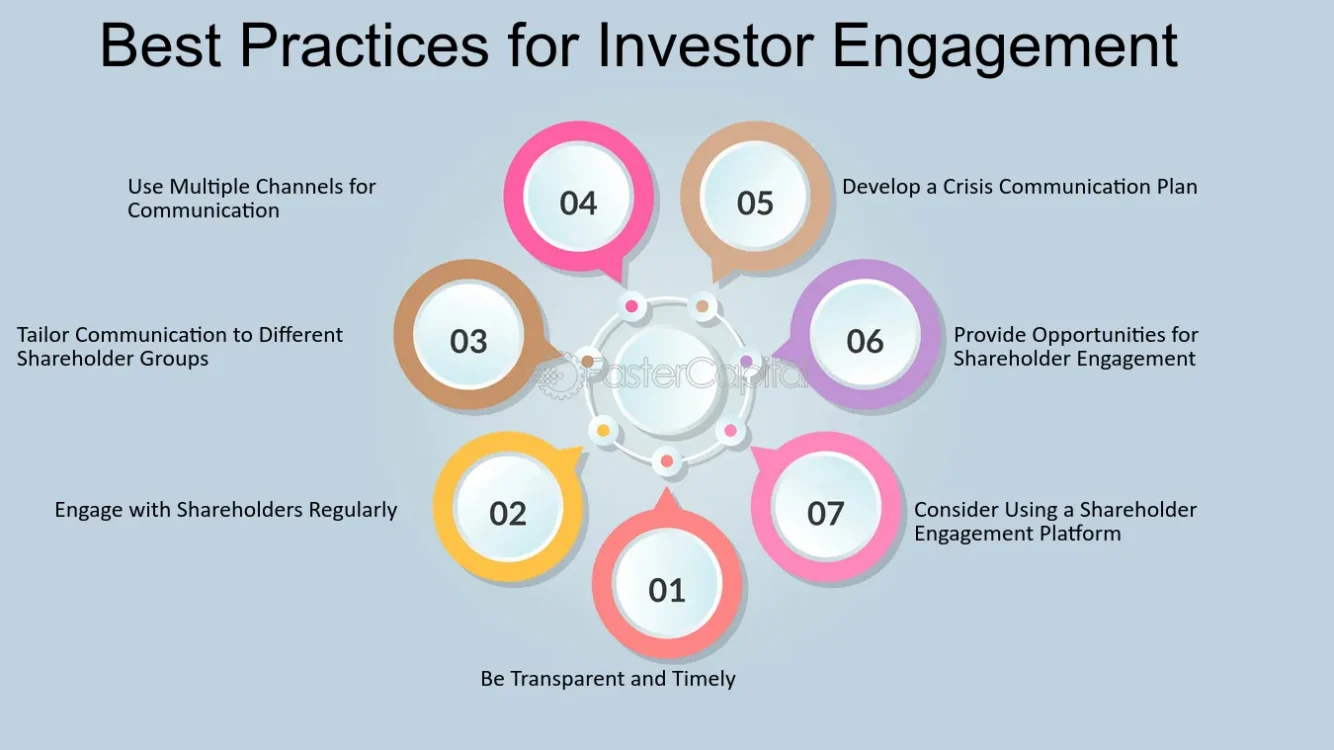

ABC Corp understood that effective IR goes beyond financial statements. It highlighted its nonfinancial and intangible assets such as innovation, intellectual capital, corporate governance, and social responsibility. The company maintained transparency and honesty, acknowledging both successes and failures to build trust.

Selecting and Implementing IR Tools

With an organisational structure in place, ABC Corp chose scalable IR tools for information dissemination. It invested in online, print, and in-person communication channels, ensuring consistency over time and across various communications. These tools were designed for low maintenance, productivity gains, and long term use.

Enhancing Shareholder Loyalty and Retention

ABC Corp implemented a shareholder relationship management (SRM) strategy similar to customer relationship management (CRM). This approach focused on improving shareholder trust, loyalty, and retention, applicable to both individual and institutional shareholders.

Dealing with Crisis Communications in IR

Having recognised that crises have direct impact on IR, ABC Corp prepared for various scenarios, including financial, business, and external crises. It followed crisis management manuals, emphasising the importance of proper planning. By being prepared, ABC Corp ensured it could effectively manage any crisis that arose.

Through these best practices, ABC Corp successfully implemented a robust IR strategy. Its thorough preparation, clear communication, and proactive management attracted a stable and diversified shareholder base, ensuring a successful IPO and a strong foundation for future growth.

Discover more from Astudity Limited

Subscribe to get the latest posts sent to your email.