Shell Faces Regulatory Snag As FG Blocks $1.3bn Oil Asset Sale

In a significant development that could reshape investment dynamics in Nigeria’s oil and gas sector, the federal government, through the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), has rejected Shell’s proposed $1.3 billion sale of its onshore oilfields to the Renaissance Group. While this decision might seem like a routine regulatory intervention, it carries profound implications […]

Read MoreSEC, NGX Empower Retail Investors Through Financial Education Initiatives

In an era where retail investors are playing an increasingly crucial role in shaping the Nigerian economy, the Securities and Exchange Commission (SEC) and the Nigerian Exchange Group (NGX) have reinforced their commitment to financial education. This collaboration seeks to bridge the knowledge gap for retail investors, empowering them to confidently sail across Nigeria’s evolving […]

Read MoreHow Nigerian Brands Are Leading The Charge In ESG Initiatives

Environmental, Social and Governance (ESG) initiatives have become a significant focus for businesses worldwide. Companies are increasingly expected to not only generate profits but also contribute positively to the environment and society while upholding strong governance principles. In Nigeria, brands are beginning to recognise the value of ESG as more stakeholders—consumers, investors, and regulators—demand greater […]

Read MoreThe Role Of Public Relations In Promoting Sustainable Business Practices In Nigeria

Sustainability has become a key concern for businesses worldwide. As the global market continues to evolve, companies are increasingly adopting sustainable business practices that not only benefit the environment but also lead to long-term growth and profitability. In Nigeria, where industries are booming and environmental challenges persist, sustainability is no longer a buzzword but a […]

Read MoreSEC To Tighten Oversight On Fintech

The Securities and Exchange Commission (SEC) is ramping up its regulatory efforts in the fintech sector to curb financial mismanagement and align operators with capital market standards. The move, aimed at protecting investors’ funds, was announced by Director-General of SEC, Mr. Emomotimi Agama, during his keynote speech at the recent Nigeria Fintech Week. Mr. Agama […]

Read MoreFidelity Bank’s Half-Year Results Reflect Strategic Drive

In today’s unpredictable economic climate, financial institutions are facing unprecedented challenges – from inflationary pressures to fluctuating interest rates and a volatile currency environment. Yet, despite these headwinds, some banks are not only surviving but thriving. A prime example of this resilience is Fidelity Bank, one of Nigeria’s tier-two financial institutions, which recently announced its […]

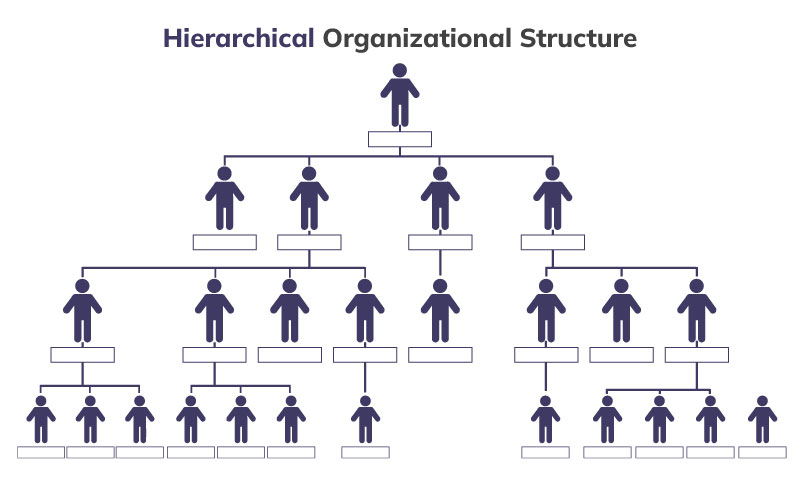

Read MoreCreating An Effective PR Environment Leveraging Organisational Structure

In the bustling corporate landscape, the architecture of an organisation significantly influences its public relations (PR) efficacy. Imagine a thriving tech startup, InnovaTech, which aims to revolutionise the tech industry with cutting-edge solutions. InnovaTech’s success story illustrates how an optimal organisational structure can amplify PR effectiveness. Valuing PR Contributions: The Bedrock of Success At InnovaTech, […]

Read MoreWhy MSMEs Should Target Highest Valuation When Sourcing For Capital

In Nigeria just as in many other countries, Micro, Small and Medium Enterprises (MSMEs) face unique challenges when struggling and competing for capital for growth and expansion. In this case, achieving the highest possible valuation can offer substantial benefits, providing a competitive edge and ensuring long-term sustainability. Below is an in-depth analysis of why MSMEs […]

Read MoreThe Role Of Technical Communication In Strategic Management

In the dynamic world of modern business, organisational success hinges on effective management and strategic public relations (PR). Let us use GreenLeaf Organics, a growing company specialising in organic food products, to illustrate how an organisation can achieve success through a well-structured PR strategy. At GreenLeaf Organics, the PR team has evolved from being mere […]

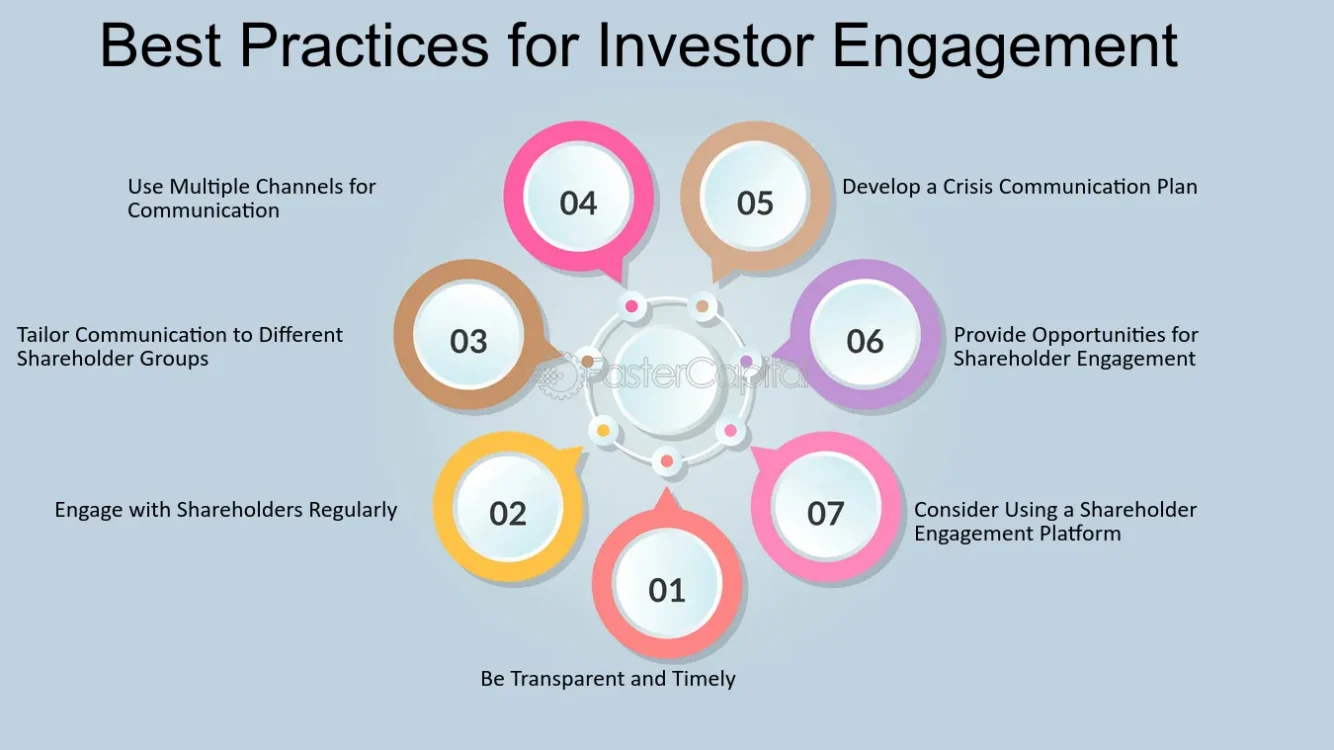

Read MoreImplementing Best Practices In IR

ABC Corp, a technology company, having prepared for its initial public offering (IPO), decided to implement a world class investor relations (IR) strategy. Below is how it leveraged best practices to ensure a successful capital raising event. Understanding Its New IR ‘Customers’ In order to build a secure shareholder base, ABC Corp prioritised identifying its […]

Read More